BTC Price Prediction: Golden Cross and Institutional Demand Signal Rally Toward $150,000

#BTC

- Technical Breakout: BTC trades above 20-day MA with MACD convergence

- Institutional Demand: Pension funds and banks accelerate crypto exposure

- Macro Alignment: Regulatory shifts and tax policies favor adoption

BTC Price Prediction

BTC Technical Analysis: Bullish Signals Emerge Amidst Key Indicators

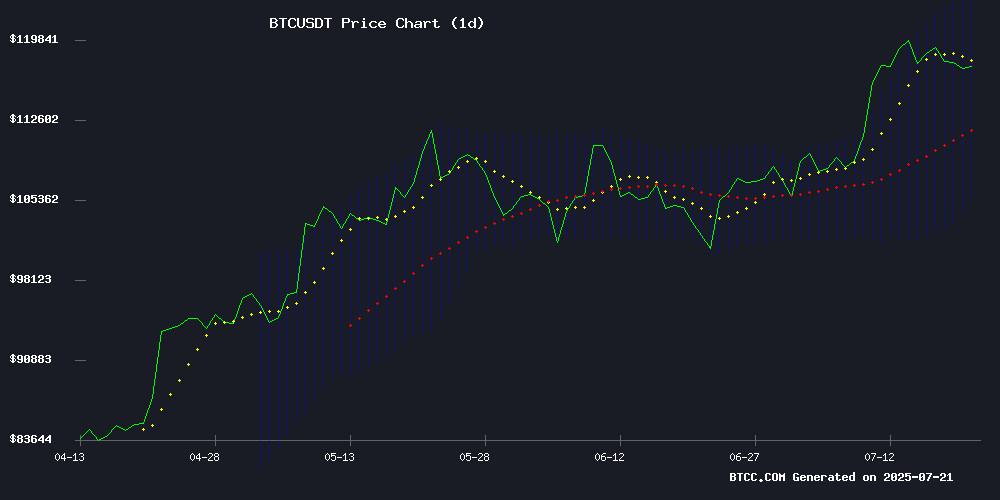

BTC is currently trading at, above its 20-day moving average (MA) of, signaling a potential bullish trend. The MACD histogram shows a narrowing bearish momentum at, while the Bollinger Bands suggest moderate volatility with the price hovering NEAR the upper band (). According to BTCC financial analyst Robert, 'A sustained break above the 20-day MA could pave the way for a retest of the $123,000 resistance level.'

Market Sentiment: Institutional Adoption and Macro Trends Fuel BTC Optimism

News headlines highlight growing institutional interest, with Ohio's pension fund reallocating into crypto and Sberbank launching custody services. Meanwhile, Bitcoin's golden cross and MicroStrategy's staggeringon its BTC bet underscore the asset's outperformance. Robert notes, 'The breakdown in BTC-altcoin correlation suggests capital rotation into Bitcoin, further supported by regulatory tailwinds like the White House's tax-free crypto policy.'

Factors Influencing BTC’s Price

Ohio Pension Fund Shifts Portfolio Toward Tech and Crypto, Cuts Lyft Exposure

The Ohio Public Employees Retirement System (OPERS) aggressively repositioned its portfolio in Q2 2025, amplifying bets on data analytics firm Palantir and crypto-focused Strategy while retreating from ride-sharing company Lyft. The $98 billion pension giant added 171,441 Palantir shares and 21,499 Strategy shares, while shedding 58,881 Lyft shares according to its 13F filing.

OPERS now holds 908,712 Palantir shares and 101,880 Strategy shares as of June 30, signaling institutional conviction in technology infrastructure plays. The moves coincide with growing pension fund interest in blockchain-adjacent investments, particularly through Strategy's Bitcoin-centric products.

This reallocation mirrors broader institutional trends favoring digital asset exposure over gig-economy stocks. The pension system's growing crypto footprint follows the GENIUS Act's recent passage, which accelerates dollar tokenization initiatives.

Altcoins Drain Bitcoin Liquidity as Correlation Breakdown Sparks Caution

Altcoins are outperforming Bitcoin, drawing liquidity away from the leading cryptocurrency and triggering warning signals. Traders are finding more profitable opportunities in altcoins, but a sharp drop in correlation with Bitcoin suggests this trend may be unstable.

Alphractal's Correlation Heatmap reveals the average correlation between Bitcoin and altcoins has declined significantly, potentially turning negative. This decoupling often precedes periods of intense volatility and mass liquidations, signaling unsustainable market behavior or capital shifts that could correct sharply.

Market participants are advised to remain vigilant, using data-driven tools like correlation metrics to navigate current conditions. The divergence between Bitcoin and altcoin positioning underscores the heightened risk of short-term altcoin profits as liquidity migrates into the space.

Big Tech Earnings and Housing Data in Focus as Bitcoin Tops $123,000

This week's market sentiment hinges on major tech earnings and housing data, with Tesla's report under particular scrutiny amid declining sales and executive departures. The electric vehicle maker's shares have dropped nearly 20% this year as European demand weakens, even as CEO Elon Musk launches new initiatives like the robotaxi service.

Housing market data due Wednesday and Thursday will likely show continued strain from high mortgage rates and low inventory. Meanwhile, the S&P 500 and Nasdaq's recent record highs face technical headwinds, raising concerns about potential pullbacks.

Bitcoin briefly surged past $123,000, injecting fresh volatility into cryptocurrency markets. The move comes as tariff threats loom between the US, Russia, and EU, with new measures potentially taking effect August 1st.

Bitcoin’s Golden Cross Sparks Anticipation for Potential Price Surge

Bitcoin's 50-day simple moving average has crossed above its 200-day SMA, triggering a golden cross—a technical indicator historically associated with bullish momentum. The pattern previously preceded parabolic rallies of 139% in 2016, 2,200% in 2017, and 1,190% in 2020, though more recent instances in 2021 and 2023 yielded modest 45-50% gains.

Analysts emphasize that sustained upside requires a decisive break above $120,000. 'A daily close beyond this threshold, followed by a successful retest, would confirm the resumption of Bitcoin's macro uptrend,' noted Rekt Capital. Market participants now watch whether the shorter moving average can maintain its position—a critical factor distinguishing explosive rallies from tepid ones.

IMF Report Exposes Discrepancy in El Salvador’s Bitcoin Strategy

The International Monetary Fund has cast doubt on El Salvador’s Bitcoin procurement strategy, revealing a stark contrast between government claims and documented holdings. Despite President Nayib Bukele’s assertions of continuous acquisitions since November 2022, the IMF’s audit shows no new purchases after February 2025, when a $1.4 billion financing agreement took effect.

Footnotes in the report clarify that apparent increases in the Strategic Bitcoin Reserve Fund stem from wallet consolidations—not fresh investments. This technical distinction undermines the narrative of expanding state-backed crypto reserves. The IMF’s monitored addresses align with agreed restrictions, framing reported growth as administrative reshuffling rather than market activity.

The findings spotlight the challenges of reconciling bullish crypto rhetoric with institutional oversight requirements. As one of the first sovereign adopters, El Salvador’s transparency struggles may influence how other nations approach digital asset integration.

Coinsilium Expands Its Bitcoin Holdings with Strategic Acquisitions

Coinsilium Group Limited has bolstered its Bitcoin portfolio with a £920,000 purchase, adding 10.25 BTC at an average price of £89,765. The Gibraltar-based firm now holds 112 BTC, valued at approximately £9.99 million, through its subsidiary Forza Gibraltar Limited.

The acquisition aligns with Coinsilium's long-standing blockchain strategy, dating back to 2015. Institutional-grade custodians safeguard the assets, reflecting a mature approach to digital asset management. A recent £1.25 million capital raise in May 2025 facilitated this strategic accumulation.

Bitcoin Price Prediction: BTC Market Cap Eyes Gold's $12 Trillion Valuation as Altcoins Gain Traction

Bitcoin's market cap trajectory dominates crypto discourse as BTC flirts with $120,000 resistance. The asset briefly touched $122,000 before correcting to $115,700, leaving analysts divided on near-term direction. Futures open interest exceeding $45 billion and robust on-chain activity suggest institutional accumulation, though the bearish engulfing candle pattern warrants caution.

The $2.36 trillion Bitcoin market cap now faces its ultimate stress test: achieving parity with gold's $12 trillion valuation. This fivefold growth requirement frames the next macro bull cycle. Meanwhile, capital rotates toward strategic altcoin plays like Remittix's payment infrastructure token and Sui's Layer 1 solutions, with both projects demonstrating eight-figure funding milestones.

Sberbank Ventures into Cryptocurrency Custody Services Amid Regulatory Shifts

Russia's largest bank, Sberbank, is making a strategic pivot into cryptocurrency custody services, capitalizing on the growing demand for secure digital asset storage. The move follows a softening stance by the Russian Central Bank, which now permits limited crypto use in international trade. Bitcoin and other digital assets will be treated similarly to traditional bank accounts, with Sberbank acting as custodian.

Anatoly Pronin, Sberbank's executive director, confirms the bank has submitted regulatory proposals to the Central Bank. "Global banks are already offering these services," Pronin notes, emphasizing Sberbank's intention to remain competitive. The custody framework includes security protocols and mechanisms to freeze assets in cases of suspected illegal activity.

This development signals institutional recognition of cryptocurrencies in Russia's financial ecosystem, particularly as businesses explore crypto-based workarounds to Western sanctions. Sberbank's entry could accelerate mainstream adoption and set a precedent for other traditional financial institutions.

White House Backs Trump’s Tax-Free Crypto Policy to Spur Adoption

The White House has endorsed a landmark policy to eliminate capital gains taxes on Bitcoin and other cryptocurrency transactions, signaling a strategic shift toward fostering digital asset innovation. President Donald Trump’s administration framed the move as a catalyst for mainstream adoption and a boon for U.S.-based fintech ventures.

Current tax regimes treat crypto profits as taxable events, creating friction for retail and institutional participants alike. The proposed exemption could reshape the regulatory landscape, mirroring early-stage incentives once deployed for internet startups. Treasury officials suggest the policy may unlock $120B in dormant capital within the crypto ecosystem.

EV Firm Volcon Shifts Strategy to Bitcoin Treasury with $500M Capital Raise

Electric vehicle manufacturer Volcon has pivoted its corporate strategy to embrace Bitcoin as a treasury reserve asset, securing over $500 million in a private placement offering. The capital injection came from institutional and accredited investors purchasing 50 million shares at $10 each, with 95% earmarked for Bitcoin acquisitions.

Empery Asset Management led the funding round, joined by prominent crypto investment firms Pantera, RK Capital, Relayer Capital, and FalconX. The company has partnered with Gemini Nustar, an affiliate of Gemini Trust Company, to handle digital asset custody services.

Volcon's strategic shift includes significant leadership changes, with Empery co-founder Ryan Lane assuming roles as co-CEO and Chairman of the Board. Three additional Empery executives joined Volcon's board to oversee implementation of the new Bitcoin-focused treasury policy.

MicroStrategy's Bitcoin Bet Yields 3,588% Return as BTC Outperforms Traditional Assets

MicroStrategy's unwavering commitment to Bitcoin has cemented its status as the most successful corporate adopter of the cryptocurrency. The business intelligence firm, now effectively a Bitcoin treasury, has seen a 3,588% return on its BTC holdings since August 2020 - a period during which Bitcoin has consistently outperformed stocks, gold, and bonds.

Chairman Michael Saylor's proclamation that "the only thing better than Bitcoin is more Bitcoin" appears validated by the numbers. With 601,550 BTC ($71.44 billion) on its balance sheet against a $42.88 billion acquisition cost, MicroStrategy sits on $28 billion in unrealized gains at current prices around $120,000 per Bitcoin.

The company's transition from software provider to Bitcoin accumulator has become a blueprint for corporate treasury management. Saylor's strategy of continuous accumulation, even during periods of market skepticism, has demonstrated the asymmetric returns possible through disciplined Bitcoin adoption.

How High Will BTC Price Go?

Based on technicals and market catalysts, BTC could target $150,000 in the medium term. Key drivers include:

| Factor | Impact |

|---|---|

| Golden Cross Formation | Historically precedes 50%+ rallies |

| Institutional Inflows | Ohio Pension Fund, Sberbank adoption |

| Macro Tailwinds | Tax policies, ETF inflows |

Robert cautions, 'While the $123,000 resistance is critical, a weekly close above it may trigger FOMO buying.'